Journey of ESG and its Relevance during Covid-19

ESG - Environmental, Social, and Governance, initially thought of as a lens to measure the societal impact of investments in businesses and firms, has evolved and has become a key focus area for investors. Since its inception in 1970 - by selective disinvestment in companies operated in South Africa to show the abhorrence against the regime, it has changed over time into a more concrete concept. Earlier, it was believed that the return on investment in sustainable businesses will comparatively be less than other businesses. But this turned out to be false. Now, after many years of empirical research by various academic researchers and investors, it has been proven that sustainable businesses are efficient and provide better financial returns.

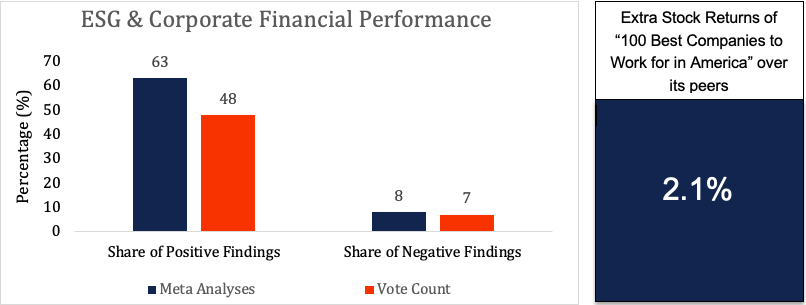

An aggregation of more than 2000 studies by Gunnar Friede, Timo Busch & Alexander Bassen in 2015 shows, approximately 90% of the studies find a non-negative correlation of ESG with corporate financial returns, of which 48% in vote-count studies and 63% in meta-analyses. In another study by Alex Edmans, Professor at Wharton School, University of Pennsylvania, shows that “100 Best Companies to Work For in America” earned an extra average of 2.1% a year in stock returns over its peers from 1984-2009.

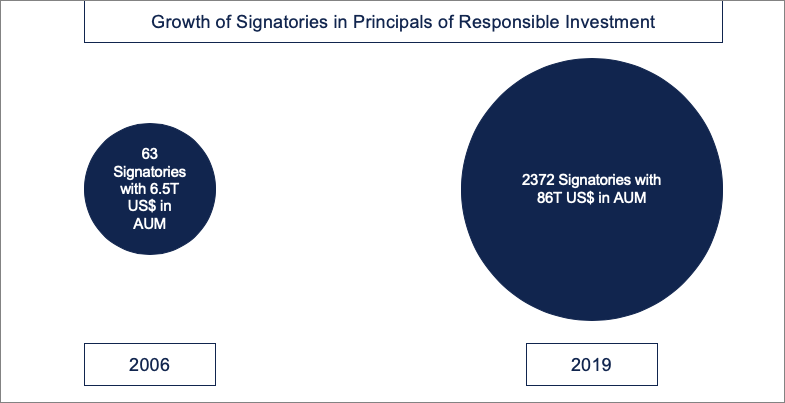

The recognition of higher financial return by investing in more sustainable businesses led to a dramatic rise in ESG investing since 2005. In early 2005, a multi-institutional group was formed, on the invitation by the then Secretary-General Kofi Annan, to create a set of Principals for Responsible Investment, PRI. It is currently the world’s leading proponent of responsible investment. The mission of the PRI is to help the financial system navigate the Principals and help them in implementing to create long-term value for investors and society. Since its inception in 2005, the number of institutional signatories has increased from 63 in 2006 to 2372 in 2019 with a CAGR of 32% and the total assets under management grew from 6.5T US$ in 2006 to 86T US$ in 2019 with CAGR of 22%.

After PRI, another major challenge was the standardization of the measurement and the reporting standards across different sectors and businesses within the same sector. Global Reporting Initiative, launched in 1997, started developing Sustainability Reporting Standards to capture and communicate the impact of businesses and governments on various key factors. Currently, more than 60000 reports of 14000 organizations are registered with the GRI database. Another organization, called, Sustainability Accounting Standards Board (SASB) is working towards establishing industry-specific reporting standards for various sustainability topics to communicate the information to stakeholders without ambiguity.

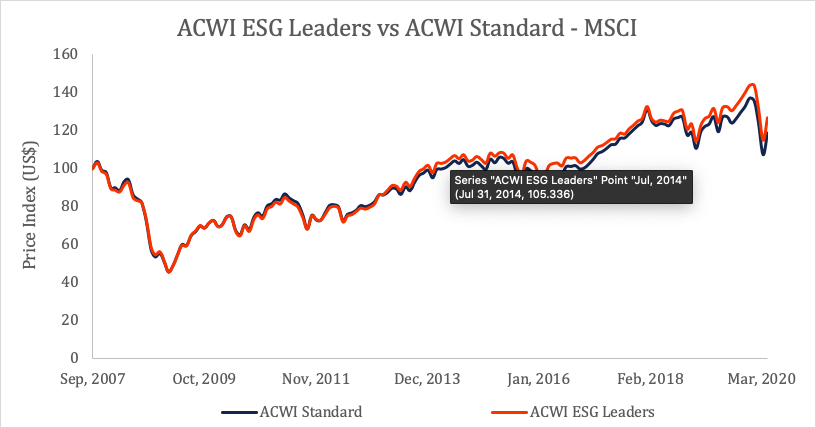

With the help of Sustainability Reporting Standards and technological developments over the last decade, the negative impact of businesses is visible to a wide variety of audiences, from institutional investors to regulatory authorities. Companies, like ISS and MSCI, track and rate businesses on ESG and provides actionable insights to executives and investors. For executives, these ratings provide a way to look into a problem carefully and take necessary actions to create more value for shareholders in the long run. For investors, it helps them to make more informed decisions and invest in businesses that are likely to over-perform than their peers. As sustainability took the front seat for corporations, investors, and regulatory authorities, the world was suddenly struck by the COVID-19 pandemic. In addition to the massive loss to human lives and families throughout the world, it also resulted in huge financial losses for corporations, governments, and start-ups in both emerging and developed economies.

As the pandemic unfolds its unpredictable nature, businesses are trying hard to remain afloat by reducing their bottom line, by various cost-cutting strategies like, layoffs, reducing or freezing hiring, and shutting down plants. These are a few ways by which corporations are trying to contain the damage of pandemic on their revenue. But the important question that arises is, whether corporations can be better prepared to deal with such crises and the agility to maneuver in the future. While, the policymakers and the executives are busy thinking about the future and the “new normal”, one important aspect to look at is the sustainability of any policy and the implications of it on both environment and society. As the pandemic has shown the world - economic prosperity depends on our environment and society, more long-term solutions are the need of the hour.

Businesses and investors focussed on creating long-term value by employing cleaner, healthier and non-discriminative policies have done better during the pandemic. This is not surprising as corporations with a higher focus on the long-term tend to avoid making trade-offs that are beneficial in the short run only. This behavior leads to a more sustainable brand with better brand acceptance, a more engaged workforce, and flexibility to maneuver through hard times. In the last four months, economic value has been eroded tremendously, especially in capital markets, by falling stock prices across the world. A comparison of MSCI All Country World Index (ACWI) of ESG Leaders with the Standard Index shows clearly that during the pandemic, stock prices of other companies lost 1.1% more than ESG Leaders between Nov 2019 to Apr 2020. The data clearly shows, even during a pandemic like Covid-19, better risk-management policies on environmental, social, and governance topics can lead to better allocation of resources without compromising the financial returns.

Conclusion: In short, Covid-19 shook the world by its devastating effects on society by eroding economic value and human lives. But it also showed - as the “new normal” evolves, the key for corporations is to focus on cleaner, efficient and non-discriminative policies. This means a higher ESG score that translates to cheaper finance, better brand name, more engaged workforce, and a better ecosystem to live in.